Inflation, exiting fossil fuels & navigating politics: The challenges facing the EBRD

By France24

05 February 2022 |

6:04 am

For more than 30 years, the European Bank for Reconstruction and Development (EBRD) has been investing in countries in Central and Eastern Europe. It's since expanded into the Middle East, Central Asia and North Africa and has plans to move into Sub-Saharan Africa too. The EBRD's President Odile Renaud-Basso discussed some of the challenges facing the development lender, including climate finance, transitioning away from fossil fuels and the Bank's pro-democracy mandate.

In this article

Related

Related

3 days ago

The Netherlands has always been known as a business-friendly country. But the country looks set to become a lot less hospitable following the result of November’s elections, in which the far right won the most votes. The four parties seeking to form a government have vowed to limit immigration, hitting both high-tech workers and students. Companies have started to voice their concern and some are even threatening to leave the country.

2 days ago

Palestinians were killed and dozens of others injured Wednesday, May 8, when Israeli fighter jets bombed the city of Rafah in the southern Gaza Strip.

2 days ago

President Joe Biden on Wednesday publicly warned Israel for the first time that the U.S. would stop supplying weapons if Israeli forces make a major invasion of Rafah, a refugee-packed city in southern Gaza.

1 day ago

Chinese President Xi Jinping's trip to the Western Balkan state strengthens the so-called steel friendship that has developed between Beijing and Belgrade. In Serbia, China is seen as the strongest ally after Russia.

1 day ago

Another high-ranking official has stepped down during continued scrutiny of corruption. That has led to questions about how the political instability could affect the ruling Communist Party.

2 days ago

About a quarter of Germans cited immigration as their main priority in 2022, which rose to 44% in the 2024 survey. About a third were most concerned about climate change two years ago, falling below the 25% mark this time.

Latest

1 day ago

Find these stories and much more when you grab a copy of The Guardian on Saturday.

1 day ago

Chad's election results are being disputed after interim President Mahamat Idriss Deby was declared the winner according to provisional results, something opposition leader Succes Masra described as an attempt to "steal" the vote.

1 day ago

From backstage to the spotlight; a young chap emerges filled with passion for dance and upcoming young stars. Osawere Austin took GuardianTV on his journey from grass to grace and the challenges he faced to reach stardom.

1 day ago

Britain's Prince Harry and his wife Meghan, the Duke and Duchess of Sussex, arrived in Nigeria's capital, Abuja, on Friday to begin a three day visit of Africa's most populous nation.

1 day ago

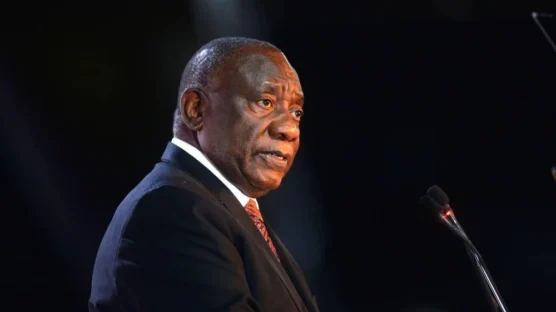

South Africa's President Cyril Ramaphosa signs a party funding bill into law, but opposition parties say the changes are unconstitutional, with some political critics even planning on mounting a legal challenge.

1 day ago

Labor unions called for people to strike against President Javier Milei's austerity agenda after the lower house of Argentina's Congress approved a downsized version of Milei's economic overhaul package in April.

×

Get the latest news delivered straight to your inbox every day of the week. Stay informed with the Guardian’s leading coverage of Nigerian and world news, business, technology and sports.

0 Comments

We will review and take appropriate action.