Increased demand from auction parties ahead of Nigeria’s PMO

By CNBC

11 September 2019 |

8:07 pm

Ahead of yesterday's Primary Market Auction (PMO), Nigeria's interbank rates expanded further as system liquidity remained stable. To review the money markets this week, Ladi Belo, Fixed Income Trader at Access Bank joins CNBC Africa for more.

In this article

Related

Related

2 May

The US Federal Reserve has decided to keep its benchmark interest rate steady at 5.25 to 5.50 percent. Fed Chairman Jerome Powell said while inflation has eased significantly over the past year, it's still too high, and that while wage growth has slowed down, the labour market remains tight.

3 May

The devaluation of the naira against the dollar has plunged Nigerians into a deep socio-economic depression. The price of basic foodstuffs can double or even triple in the same day.

2 May

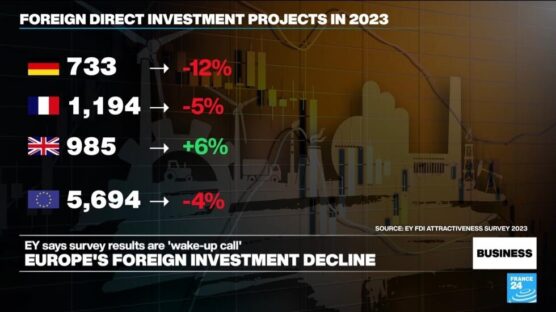

The number of foreign direct investment projects in Europe fell 4 percent in 2023 compared to the previous year, the first decline since the pandemic.

2 May

China's minister of commerce is in Europe for a week-long trip, with a focus on pushing back against accusations of unfair state subsidies in the Chinese electric vehicle sector.

2 days ago

Cryptocurrencies such as bitcoin promise quick profits – an attraction that aids scammers fleecing investors of their funds.

1 day ago

With inflation taking a toll on people's finances and amid a growing sense of responsibility towards the climate, second-hand shops are booming across the globe. In France, around 10 percent of clothes each year are now resold, and thrift stores are attracting a wider audience.

Latest

4 hours ago

Find these stories and much more when you grab a copy of The Guardian on Thursday.

6 hours ago

The Netherlands has always been known as a business-friendly country. But the country looks set to become a lot less hospitable following the result of November’s elections, in which the far right won the most votes. The four parties seeking to form a government have vowed to limit immigration, hitting both high-tech workers and students. Companies have started to voice their concern and some are even threatening to leave the country.

6 hours ago

South Africa's coastal city of Durban, known for its popular beaches and warm climate, is facing a severe water crisis ahead of national elections, with residents suffering from prolonged dry taps and poor sanitation services.

8 hours ago

Her powerful performances give voice to some uncomfortable truths. Lebanese playwright and director Chrystèle Khodr wades through the ruins of a society in her latest play "Ordalie", exploring the social, political and physical wreckage of her homeland and its history. She tells us more about the quest for justice in contemporary Lebanon, why 19th-century playwright Henrik Ibsen is a fitting contemporary inspiration and how making theatre in a crisis-ridden country is a constant endeavour of creativity and solidarity among artists.

8 hours ago

Paris 2024 official partner ArcelorMittal made 2,000 torches for the Paris 2024 Olympic and Paralympic Games.

10 hours ago

Jan Egeland, secretary general of the Norwegian Refugee Council and a former top UN humanitarian official, told FRANCE 24 on Tuesday that Gaza is "among the worst places in humanitarian history". He described a trapped population enduring "relentless" bombardment since October 2023. With regards to the southern city of Rafah, where an Israeli offensive appears imminent, he said some 1.4 million people were "engulfed in fear and desperation beyond belief".

×

Get the latest news delivered straight to your inbox every day of the week. Stay informed with the Guardian’s leading coverage of Nigerian and world news, business, technology and sports.

0 Comments

We will review and take appropriate action.