Access Bank: Investor appetite in bond market remains soft

By CNBC

26 August 2019 |

9:02 am

Traders say the pressure on funding rates is likely to increase in Nigeria’s money market as the market is not slated to receive any inflow today. Currently, investors’ appetite in the bonds market remains soft. To discuss the trends in Nigeria’s fixed income and Forex market, Bukky Aregbesola, Head of Fixed Income at Access Bank joins CNBC Africa for more.

Related

Related

1 day ago

To mark International Workers' Day, anti-poverty NGO Oxfam has released analysis showing that between 2020 and 2023, shareholders saw their dividend payments increase by 45 percent while workers saw their wages increase by just 3 percent.

1 day ago

The devaluation of the naira against the dollar has plunged Nigerians into a deep socio-economic depression. The price of basic foodstuffs can double or even triple in the same day.

1 day ago

The US Federal Reserve has decided to keep its benchmark interest rate steady at 5.25 to 5.50 percent. Fed Chairman Jerome Powell said while inflation has eased significantly over the past year, it's still too high, and that while wage growth has slowed down, the labour market remains tight.

14 hours ago

The devaluation of the naira against the dollar has plunged Nigerians into a deep socio-economic depression. The price of basic foodstuffs can double or even triple in the same day.

1 day ago

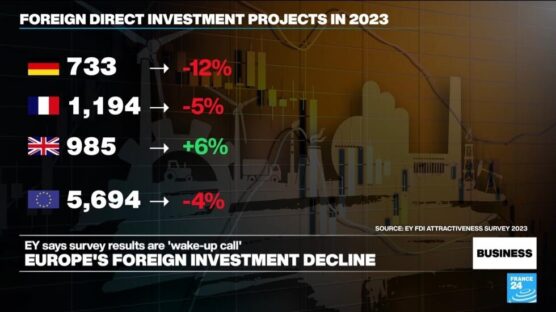

The number of foreign direct investment projects in Europe fell 4 percent in 2023 compared to the previous year, the first decline since the pandemic.

1 day ago

China's minister of commerce is in Europe for a week-long trip, with a focus on pushing back against accusations of unfair state subsidies in the Chinese electric vehicle sector.

Latest

2 hours ago

Find these stories and much more when you grab a copy of The Guardian on Saturday.

2 hours ago

More than six months after the start of Israel's devastating offensive in response to the October 7 attacks, Palestinian journalists in Gaza continue to pay a heavy price.

8 hours ago

According to a UNESCO report, a whopping 70 percent of environmental reporters regularly face threats, attacks and intimidation. Meanwhile, UNESCO awards its World Press Freedom Prize to all Palestinian journalists covering the war in Gaza, who are paying a heavy price for their reporting.

8 hours ago

The bus was traveling from a city near the capital, Islamabad, to the mountainous region of Gilgit-Baltistan, near the Chinese border. Road accidents are common in Pakistan due to poor roads and driver training.

11 hours ago

Britain's opposition Labour Party won a parliamentary seat in northern England on Friday and control of several councils, inflicting heavy losses on the governing Conservatives to pile more pressure on Prime Minister Rishi Sunak.

×

Get the latest news delivered straight to your inbox every day of the week. Stay informed with the Guardian’s leading coverage of Nigerian and world news, business, technology and sports.

0 Comments

We will review and take appropriate action.