The drivers of Trump’s tax cut plan

By Bloomberg

27 September 2017 |

2:19 pm

Rohit Kumar, tax policy services leader at PWC, explains how corporate and private cuts can be paid for in President Donald Trump's tax plan.

In this article

Related

Related

1 day ago

India's mammoth elections are now under way, with Prime Minister Narendra Modi widely expected to win a third term. Since coming to power in 2014, Modi has expanded subsidy programmes for the poor and women. These programmes include measures like equipping homes with butane gas by offering free cylinders or distributing free food rations. Some 60 percent of the population benefits from Modi’s food distribution scheme, which he has pledged to renew for another five years. Another success story is the nationwide rollout of digital payment services. Meanwhile, critics say the prime minister is eroding democracy by targeting opposition parties and controlling the media.

1 day ago

A world record of 969 million citizens are called to the polls for what some see as a referendum on one man. India is about to embark on the world's biggest election, staggered over seven weeks, with Narendra Modi’s Hindu nationalist BJP expected to extend its solid lead in parliament. Modi has been pointing to a decade of unprecedented growth and power for a nation courted by the West and beyond.

1 day ago

India's mammoth elections are now under way, with Prime Minister Narendra Modi widely expected to win a third term. Since coming to power in 2014, Modi has expanded subsidy programmes for the poor and women.

42 mins ago

Three French diplomats were given 48 hours to leave Burkina Faso on Thursday after being declared persona non grata by the ruling junta. The trio have been accused of "subversive activities", allegations that Paris denies. Relations between the two countries have been unravelling since 2022, when Burkina Faso saw its second coup in less than nine months.

6 hours ago

Iranian state media have reported loud explosions in the sky near the central city of Isfahan. Tehran says say its air defense systems were activated at a nearby military base and a nuclear facility.

6 hours ago

In this week’s special edition of Access Asia, we focus on India as the country's record-breaking election gets under way. In the past few years, India's ranking in the World Press Freedom Index has plummeted.

Latest

39 mins ago

A Kenyan national flag flies at half mast in Nairobi on April 19, 2024, in honor of its defense chief General Francis Omondi Ogolla and nine other senior military officers who were killed in a helicopter crash.

1 hour ago

Following the arrest of suspected left-wing terrorist Daniela Klette in Berlin, investigators are now hoping for new insights into crimes committed by the Red Army Faction.

1 hour ago

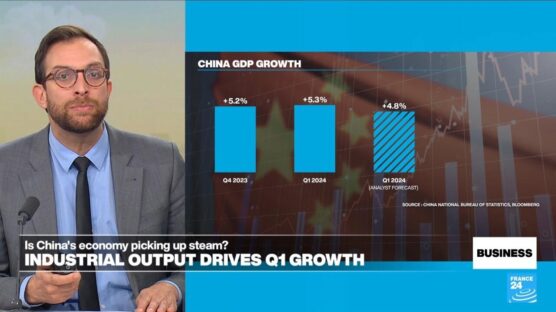

China's National Bureau of Statistics said on Monday that the country's economy grew to the tune of 5.3 percent in the first three months of the year, ahead of economists' expectations. Manufacturing and infrastructure are fuelling that growth, while housing and domestic consumption are still a source of concern. Meanwhile, German Chancellor Olaf Scholz is on a three-day visit to China, Berlin's top trading partner

1 hour ago

Maya Rudolph is back with a second season of her quirky billionaire workplace comedy, "Loot", while Oscar winner Robert Downey Jr dons multiple disguises for his role in the Vietnam War spy drama "The Sympathizer". Dheepthika Laurent and Olivia Salazar-Winspear also bring you the latest news from Canneseries, including Michael Douglas's historical drama "Franklin" and a biopic about Karl Lagerfeld.

4 hours ago

Scientists are testing a quadrupedal robot, named Spirit, in the rugged terrain of Oregon's Mount Hood, simulating the extreme conditions of the Moon and Mars.

4 hours ago

Can new laws against hate speech online also reduce harassment in the VTuber scene?

×

Get the latest news delivered straight to your inbox every day of the week. Stay informed with the Guardian’s leading coverage of Nigerian and world news, business, technology and sports.

0 Comments

We will review and take appropriate action.