US banks set aside $28 billion to cover loan losses from Covid-19 pandemic

By France24

16 July 2020 |

9:00 am

Three of the largest banks in the United States have dramatically increased their reserves to cover losses from unpaid loans. JP Morgan, Wells Fargo and Citigroup have together set aside $28 billion to cover bad debts in the three months from April to June. The lenders are expecting the damage from this crisis to be protracted, and unemployment in the US to remain over 10 percent until the end of the year, with knock-on effects on the repayment of loans from households and businesses.

In this article

Related

April 15, 2024

Related

11 Apr

Some countries in Europe have begun to ban short-haul flights to cut emissions. Will other countries follow? And — can these bans make a real difference?

15 Apr

Here's what's been making the business headlines in sub-Saharan Africa this week.

13 Apr

Nigeria’s Minister of Finance, Wale Edun says 4.83 trillion naira from T-Bills and Bonds issued in the first quarter of this year was used to pay part of the Ways and Means advances from the Central Bank of Nigeria. Sam Chidoka, CEO of Kairos Capital joins CNBC Africa for more on this discussion and Nigeria's debt management strategy.

4 days ago

A year after Lula came to power, his gamble has paid off: deforestation has been halved in the Amazon. But this success comes at the cost of sacrificing another ecosystem that's just as vital to Brazil: the Cerrado.

4 days ago

Some top Nigerian banks are eyeing the international and local capital markets to raise fresh capital in a bid to meet the recapitalisation exercise by the Central Bank of Nigeria. Egie Akpata, Chairman of Skymark Partners joins CNBC Africa to examine options available to banks.

2 days ago

According to the International Monetary Fund (IMF), a 10% rise in the dollar on the currency market would push down real gross domestic product (GDP) in emerging economies by 1.9% after one year, with adverse economic effects lasting more than two years

Latest

10 mins ago

Following the arrest of suspected left-wing terrorist Daniela Klette in Berlin, investigators are now hoping for new insights into crimes committed by the Red Army Faction.

10 mins ago

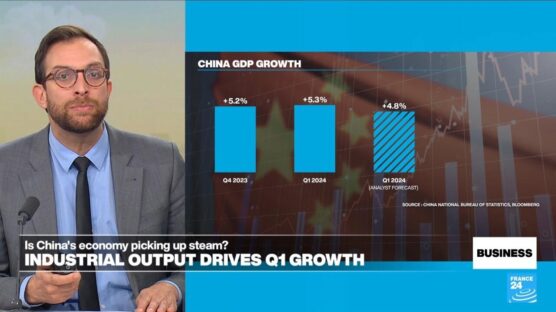

China's National Bureau of Statistics said on Monday that the country's economy grew to the tune of 5.3 percent in the first three months of the year, ahead of economists' expectations. Manufacturing and infrastructure are fuelling that growth, while housing and domestic consumption are still a source of concern. Meanwhile, German Chancellor Olaf Scholz is on a three-day visit to China, Berlin's top trading partner

11 mins ago

Maya Rudolph is back with a second season of her quirky billionaire workplace comedy, "Loot", while Oscar winner Robert Downey Jr dons multiple disguises for his role in the Vietnam War spy drama "The Sympathizer". Dheepthika Laurent and Olivia Salazar-Winspear also bring you the latest news from Canneseries, including Michael Douglas's historical drama "Franklin" and a biopic about Karl Lagerfeld.

3 hours ago

Scientists are testing a quadrupedal robot, named Spirit, in the rugged terrain of Oregon's Mount Hood, simulating the extreme conditions of the Moon and Mars.

3 hours ago

Can new laws against hate speech online also reduce harassment in the VTuber scene?

3 hours ago

Tunde Onakoya, a chess mastermind and founder of Chess in Slums Africa, has completed an incredible feat! He embarked on a journey to break the Guinness World Record for the longest chess marathon without a loss, aiming to surpass the existing mark of 56 hours and 9 minutes. And in the early hours of today, Saturday, April 20th, Tunde emerged victorious!

×

Get the latest news delivered straight to your inbox every day of the week. Stay informed with the Guardian’s leading coverage of Nigerian and world news, business, technology and sports.

0 Comments

We will review and take appropriate action.