Tariffs take the cake in fed debate

By Bloomberg

01 September 2019 |

9:43 am

Central bankers from around the world gathered in Jackson Hole against a backdrop of recession fears and escalating trade tensions. Risk assets sold off after China announced retaliatory tariffs right as comments emerged from Fed Chairman Jay Powell Out of Wyoming. Bloomberg's Lisa Abramowicz sat down with Voya’s Matt Toms, Aberdeen’s Luke Hickmore and Jim Keegan of Seix Investments to discuss just how low treasury yields could go and whether the trade war would last longer than a boost from a fed rate cut.

In this article

Related

2 days ago

Related

2 days ago

Talking Europe hosts former Spanish foreign minister Arancha Gonzalez Laya, who is now dean of one of the top international relations schools in the world – the Paris School of International Affairs.

2 days ago

The United Arab Emirates struggled on Thursday to bring life back to normal, after an unprecedented flood inundated its futuristic Dubai city, flooding roads and highways and rendering its airport inoperable.

3 days ago

A Kenyan national flag flies at half mast in Nairobi on April 19, 2024, in honor of its defense chief General Francis Omondi Ogolla and nine other senior military officers who were killed in a helicopter crash.

2 days ago

Nigeria has halved government borrowing from the central bank, Finance Minister Wale Edun told Reuters in an interview on Thursday, as Africa's biggest economy works to curb monetary financing and turn to markets to plug revenue shortfalls.

5 hours ago

Only 40 of 100 private firms studied have pledged to achieve zero carbon emissions, compared to 70 out of 100 publicly-listed firms. Net Zero Tracker blames a lack of market and reputational pressures, as well as an absence of regulation.

12 hours ago

South Africa is edging closer to a major healthcare overhaul with a bill that aims to provide universal coverage, but concerns are mounting over whether the struggling public system is ready to implement such an ambitious plan, healthcare workers, patients and business groups say.

Latest

1 hour ago

The heat of the Premier League title race is on and big games are coming this midweek. Arsenal at the Emirates will take on Chelsea, Everton will entertain Liverpool, and Manchester City will be up against Brighton. Ayomide Sotunbo and Hogan Niyi preview the games in this week's edition of The Nutmeg.

1 hour ago

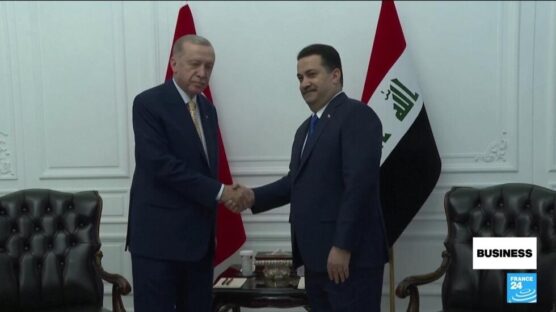

Turkey's president Recep Tayyp Erdogan was in Iraq this Monday - his first official visit in years, where he signed a raft of deals to try and reset rocky relations. High on the agenda was the water issue, stemming from Turkey's construction of dams on the Tigris and Euphrates rivers that reduced the supply downstream to Iraq.

1 hour ago

A book by Frank-Walter Steinmeier titled 'We' searches for diversity in the face of division, though it's a difficult balancing act for the head of state.

2 hours ago

North Korean state media has claimed Pyongyang tested a "nuclear trigger" simulation drill as a "warning signal" to the US and South Korea.

2 hours ago

A review of the UN agency's neutrality was prompted by Israeli accusations that aid workers in Gaza were "terrorists." An independent panel says Israel provided no evidence to back the claim.

3 hours ago

Unrelated images are going viral on social media, claiming to show last Friday's retaliatory strike by Israel on Iran. In this edition of Truth or Fake, we tell you what we know about this footage, based on verified images.

×

Get the latest news delivered straight to your inbox every day of the week. Stay informed with the Guardian’s leading coverage of Nigerian and world news, business, technology and sports.

0 Comments

We will review and take appropriate action.