Cracks start to show for U.A.E. banks

By Bloomberg

19 January 2019 |

2:30 pm

Cracks are starting to show in the U.A.E. banking sector as a property and retail slump take a toll on lenders. While one of the country's smallest banks is being bailed out, problem loans are set to rise this year and lenders are exploring mergers to remain competitive.

Related

Related

1 day ago

Aigboje Aig-Imoukhuede, the Chairman of Access Holdings says the move by the group to raise $1.5 billion over five years reflects the financial institutions growth plans. Speaking with CNBC Africa's Kenneth Igbomor, Aig-Imoukhuede reiterates that the decision for a rights issue was in line with the role of its shareholders in the growth of the bank over the years.

2 days ago

South Africa is edging closer to a major healthcare overhaul with a bill that aims to provide universal coverage, but concerns are mounting over whether the struggling public system is ready to implement such an ambitious plan, healthcare workers, patients and business groups say.

1 day ago

Infusions, anti-aging creams or anti-stress drops made from cannabis are some of the food supplements that Morocco will begin to market imminently and that are already on display at the International Agriculture Exhibition (SIAM) inaugurated this Monday, after legalization of this plant in 2021 for pharmaceutical and industrial uses.

1 hour ago

The European Commission on Wednesday announced it is launching an investigation into Chinese public procurement of medical devices.

1 day ago

The German government revised its economic growth forecast for 2024 marginally from 0.2% to 0.3%, Economy Minister Robert Habeck confirmed on Wednesday afternoon.

8 hours ago

Private sector players are urging the Nigerian government to suspend the increase in electricity tariff for band A customers, citing the recent appreciation of the naira, a part of the determining factor for the tariff. Segun Ajayi-Kadir, Director General of the Manufacturers Association of Nigeria, joins CNBC Africa for this and more.

Latest

4 mins ago

Eye on Africa tours the Hope Hostel in Kigali. It's one of the lodgings prepared by Rwanda to take in migrants deported from Britain, the first of whom could arrive in a few months' time under a controversial policy.

6 mins ago

After years of a successful sporting career, Nigeria’s four-time kickboxing gold medalist, Jibrin Inuwa Baba, pays homage to his town Kano where he meets his coach at the Dambe boxing arena. His hope is to see young athletes equally succeed in their boxing career.

1 hour ago

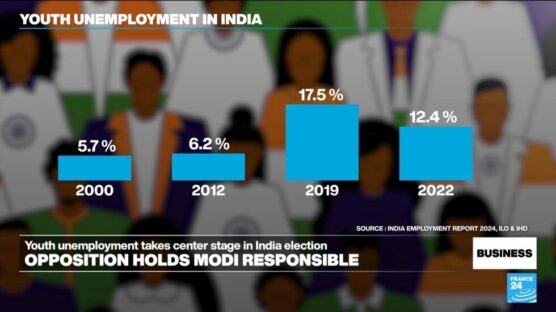

As India's opposition leader Rahul Gandhi claims on the campaign trail that Prime Minister Narendra Modi has made the country into a "centre of unemployment", we look at the situation that young Indians face on the job market. Also in this edition, the US will see its first high-speed rail line in 2028, when commuters will be able to travel from Los Angeles to Las Vegas in just over two hours.

4 hours ago

Guardian Woman Festival: Fostering inclusion and empowerment in aviation.

8 hours ago

Amnesty International is accusing Israel of a flagrant disregard for international law during its offensive in Gaza. The organisation's annual report says the situation is being compounded by the failures of Israel's allies to stop the indescribable civilian bloodshed being seen in the Palestinian enclave.

8 hours ago

The president of the Confederation of African Football (CAF) Patrice Motsepe discussed his ambitions for African football and his tenure as CAF president.

×

Get the latest news delivered straight to your inbox every day of the week. Stay informed with the Guardian’s leading coverage of Nigerian and world news, business, technology and sports.

0 Comments

We will review and take appropriate action.