CBN to raise N177bn via treasury bills auction

By CNBC

30 June 2017 |

10:31 am

The Central Bank of Nigeria plans to raise 177 billion naira of short-dated Treasury bills at an auction on the 5th of July to finance the country's budget deficit, help manage liquidity and curb inflation.

In this article

Related

2 days ago

Related

2 days ago

Talking Europe hosts former Spanish foreign minister Arancha Gonzalez Laya, who is now dean of one of the top international relations schools in the world – the Paris School of International Affairs.

2 days ago

The United Arab Emirates struggled on Thursday to bring life back to normal, after an unprecedented flood inundated its futuristic Dubai city, flooding roads and highways and rendering its airport inoperable.

4 days ago

Find these stories and much more when you grab a copy of The Guardian on Saturday.

3 days ago

A Kenyan national flag flies at half mast in Nairobi on April 19, 2024, in honor of its defense chief General Francis Omondi Ogolla and nine other senior military officers who were killed in a helicopter crash.

2 days ago

Nigeria has halved government borrowing from the central bank, Finance Minister Wale Edun told Reuters in an interview on Thursday, as Africa's biggest economy works to curb monetary financing and turn to markets to plug revenue shortfalls.

5 hours ago

South Africa is edging closer to a major healthcare overhaul with a bill that aims to provide universal coverage, but concerns are mounting over whether the struggling public system is ready to implement such an ambitious plan, healthcare workers, patients and business groups say.

Latest

1 hour ago

Guardian Woman Festival: Woman Revolution - Transforming Economic Sector

1 hour ago

The world of work is undergoing a rapid transformation, constantly reshaping how we think about work, careers, and success. The rise of remote work, the increasing importance of skills over degrees and of course, the impact of artificial intelligence and automation has all led to what we now call the new work era.

1 hour ago

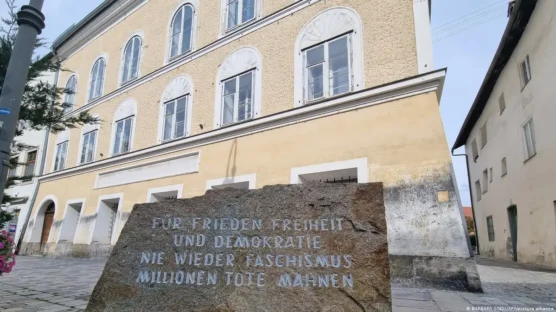

Austrian police have arrested two young couples from Bavaria after they visited the birthplace of Adolf Hitler. Officers took action when they saw a woman in the group performing a Nazi salute.

6 hours ago

A museum in Nigeria is attracting visitors with decoration and works of art made from upcycled materials. The museum wants to encourage recycling to protect the environment and teach young people how to live more sustainably.

1 day ago

The British Parliament is once again voting on a plan to send asylum seekers to Rwanda. Prime Minister Rishi Sunak has said the flights will go ahead "come what may."

1 day ago

World Athletics has broken ranks with other sports federations in opting to pay athletes bonuses for medals at the 2024 Paris Olympics. Some deem this a breach of the Olympic spirit, while others think it’s long overdue.

×

Get the latest news delivered straight to your inbox every day of the week. Stay informed with the Guardian’s leading coverage of Nigerian and world news, business, technology and sports.

0 Comments

We will review and take appropriate action.